U.S.-China Trade Tensions Escalate as Rare Earth Export Restrictions Impact Europe

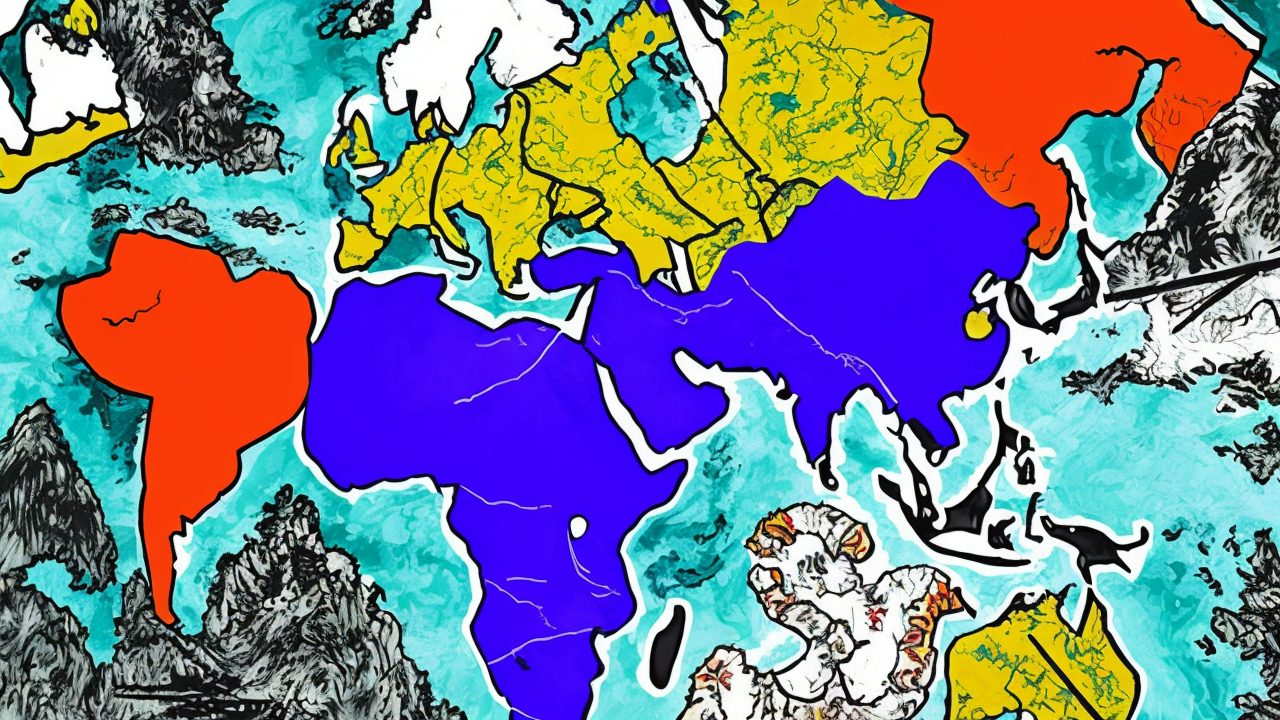

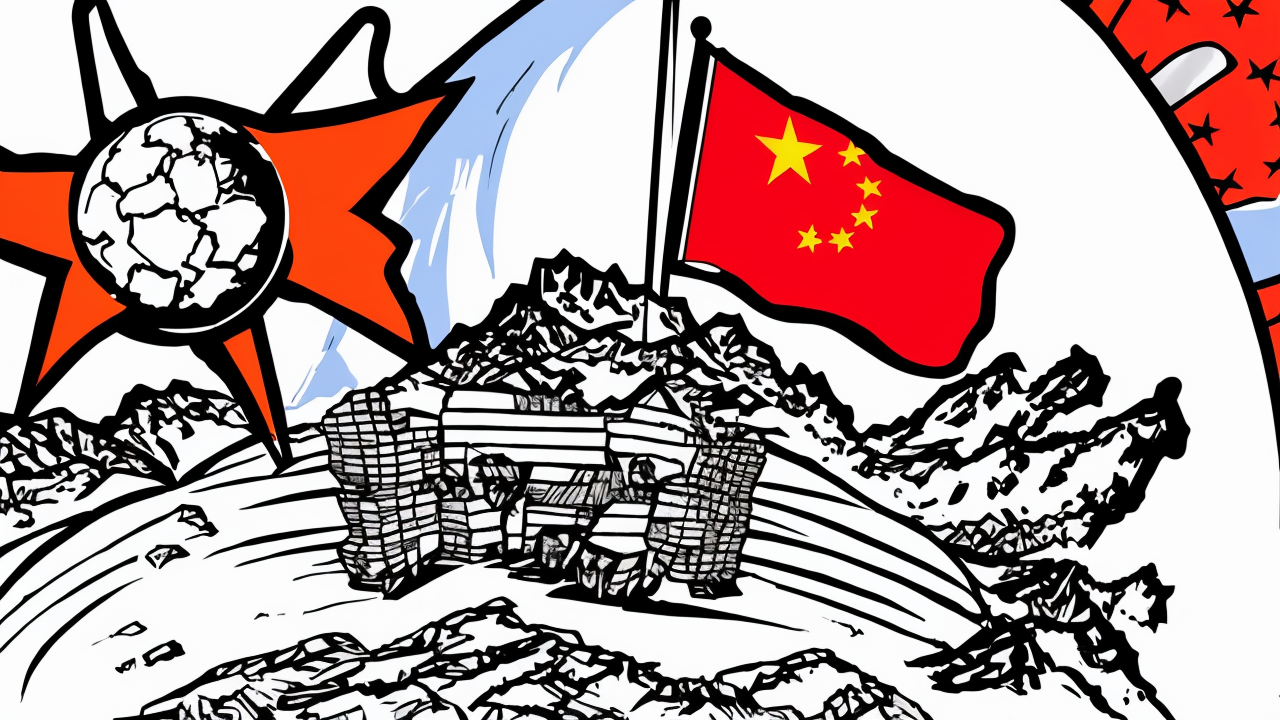

As U.S. tariffs intensify pressure on China’s export sector, Beijing is countering with strategic moves to bolster its position. The latest action involves tightening export restrictions on rare earths, critical components for industries ranging from electric vehicles to defense systems. China currently controls nearly 85% of global rare earth refining, giving it significant leverage in the ongoing trade standoff.

Europe is feeling the immediate repercussions. With over 85% of its rare earth supply sourced from China, Germany’s industrial sector is at risk of severe disruption. Since April 2025, China has restricted rare earth exports to licensed firms, effectively creating an embargo. This move has already forced several German manufacturers to scale back operations, and further shutdowns loom as global supply chains face growing strain.

The U.S. holds significant market power, with 25% of global consumption originating from its domestic market. China’s decision to weaponize its rare earth dominance underscores the escalating tensions between the two superpowers. Meanwhile, Europe is caught in the crossfire, grappling with its reliance on Chinese raw materials and the strategic vulnerabilities this creates.

As the trade war escalates, both sides are leveraging economic tools as geopolitical weapons. China’s rare earth restrictions are a calculated pressure tactic, while the U.S. seeks to reduce its trade deficit and restore domestic industrial capacity. The stakes are high, with national interests taking precedence over globalist courtesies.

The situation highlights the fragility of global supply chains and the growing risks of economic dependency. For Europe, the choice is clear: prioritize short-term gains or safeguard against long-term strategic vulnerabilities in the face of escalating trade tensions.

Published: 6/5/2025