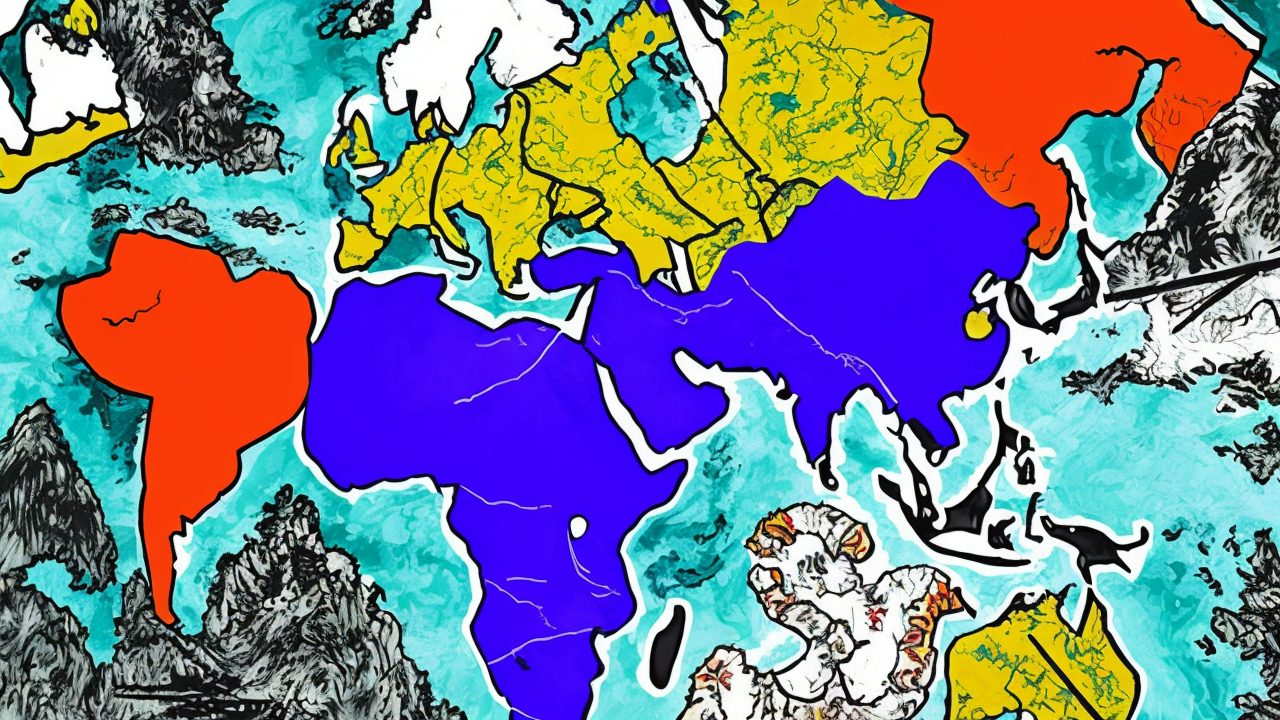

Israel-Iran Conflict Threatens China’s Oil Supply and Strategic Interests

As tensions escalate between Israel and Iran, China’s substantial reliance on Iranian oil and a $400 billion trade deal with Tehran are at risk. Over 90% of Iran’s oil exports go to China, which sanctions have made cheaper than global prices. However, if Iran’s regime collapses, China could face severe economic losses and setbacks to its strategy of using the Middle East to counter Western influence.

Iran’s oil payments are made in Chinese RMB, and Tehran must purchase large quantities of Chinese goods, deepening its economic dependence on Beijing. Analysts warn that if Israel disrupts Iran’s oil exports, China’s refineries may struggle to secure supplies elsewhere.

Experts note that China’s $400 billion deal with Iran is largely symbolic, with much of Iran’s oil used to repay debts to China. If the regime falls, this agreement could become worthless. The conflict has also weakened Iran’s influence in the Middle East, diminishing China’s ability to expand its geopolitical reach.

The U.S. is now dominating the region, potentially shifting focus to counter China in the Indo-Pacific. As the war escalates, China’s investments in Iran may be lost, and its global expansion plans could be severely impacted.

Published: 6/19/2025