Financial Advisers Challenge Texas Law Targeting Climate Proposals

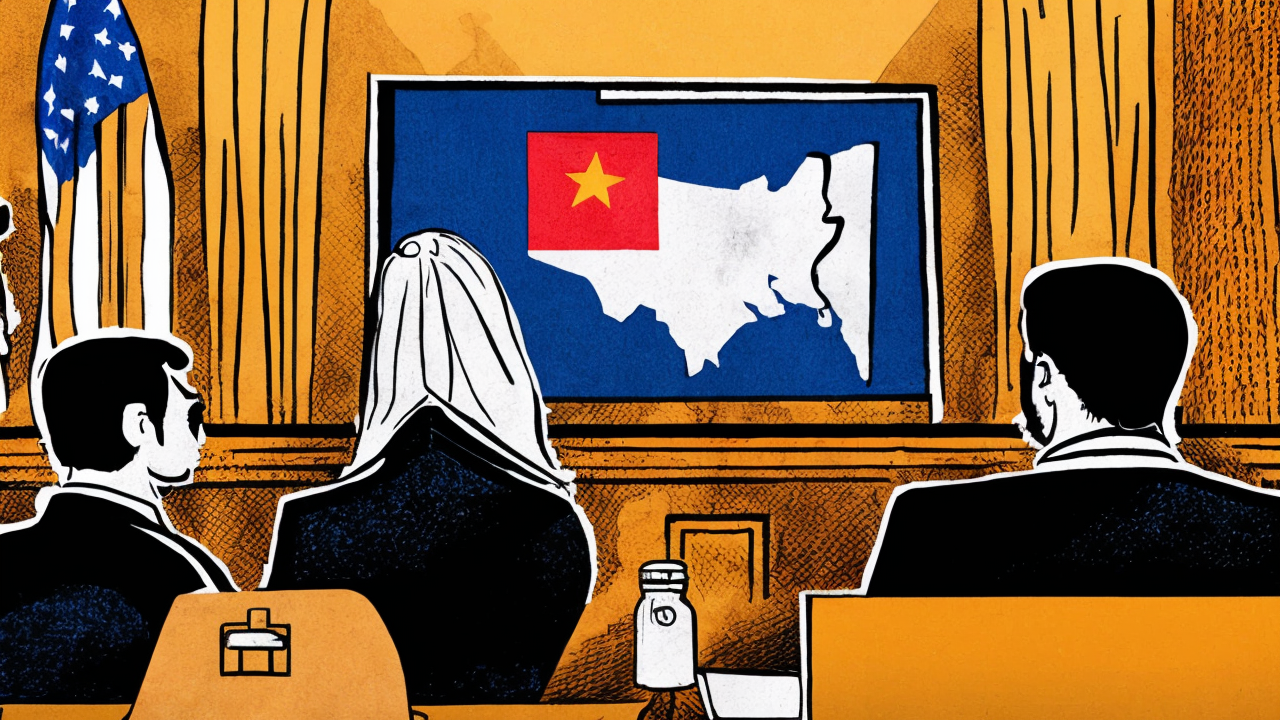

The nation’s largest shareholder advisory firms are rushing to block a Texas law set to take effect next month, claiming it would hinder their ability to provide accurate information to clients about corporate climate risks. The law, S.B. 2337, requires firms like Institutional Shareholder Services (ISS) and Glass Lewis to disclose to clients when they provide voting advice on environmental, social, or governance (ESG) issues that are not deemed “solely in the financial interest of shareholders.” Non-compliance could result in fines of $10,000 per violation.

Passed by the Republican-controlled Texas Legislature and signed into law by Gov. Greg Abbott in June, the law aims to restrict the influence of ESG considerations in corporate decision-making. However, advisory firms argue that the law could have a chilling effect on their ability to discuss critical environmental risks with clients.

These firms play a crucial role in helping pensions, mutual funds, and asset managers prepare for annual shareholder meetings, where votes on ESG resolutions and board candidates are often held. The law’s implementation could complicate the advisory process, as firms would need to carefully navigate the new disclosure requirements while advising clients on climate-related risks.

The legal battle over S.B. 2337 highlights the growing divide over the role of ESG factors in corporate governance and the broader debate over state regulation of financial advice.

Published: 8/13/2025